Direct Loans

Federal student loans offered by the U.S. Department of Education (ED) to help eligible students cover the cost of higher education. Find more information about Direct Loans below.

Direct Loans

Federal student loans offered by the U.S. Department of Education (ED) to help eligible students cover the cost of higher education. Find more information about Direct Loans below.

Direct PLUS (Parent PLUS) Loan

Direct Parent PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay for their student's degree. Find more information about Direct PLUS Loans below.

Although student loans are a convenient source of funding for your education, it is important to budget and borrow carefully.

Take very seriously the responsibility of borrowing and repaying an educational loan.

How conscientiously you make payments on your student loan will affect your ability to borrow for a car, a house, or other purchases in the future. If you are late with your student loan payments, it will have a negative effect on your credit history. On the other hand, repaying your student loan on time can help you establish and maintain an excellent credit history.

Preventing Default

Default is a legal term used when a borrower fails to repay a loan according to the terms of the signed promissory note. For a Federal Direct Student or Parent PLUS Loan, default occurs when the borrower fails to make a payment for 270 days under the normal repayment plan, and has not requested deferment of payment according to the Department of Education's standards.

Defaulting on a loan affects not only the borrower, but also the college or university as well as the US taxpayer. The borrower will experience negative consequences to his or her credit rating, garnishment of wages and collection from federal funds such as tax refunds or Social Security benefits.

If many borrowers at a particular college or university go into default status, the institution can lose the ability to participate in federal student aid programs, denying future students the ability to receive financial aid to help pay for college.

When borrowers default, the US government eventually must write off the loss, and passes the losses on to the taxpayer, either in the form of higher taxes, higher deficits, or the loss of other programs and benefits that the funds might have been used for instead.

Contact your lender(s) if you are having problems making your payments. You might qualify for a forbearance, which allows you to stop making payments for a time period while keeping your loans in good standing.

To be eligible for a Federal Direct Loan, you must meet the following criteria:

How to apply

The Direct Loan application is a three-step process. If you do not complete all three steps, your loan will not be processed.

Subsidized

The federal government pays the interest on a subsidized loan while the student is in school at least half-time. After the student enters repayment (six month after dropping below half-time or leaving school), interest will begin to accrue. Students should contact their federal loan servicer for more information.

Unsubsidized

Interest does accrue on an unsubsidized loan while you are in school. You may choose to pay interest while in school in order to avoid "paying interest on interest" (capitalizing interest).

Interest rates

The Direct Loan interest rate varies annually with a maximum rate of 8.25% for undergraduates and 9.5% for graduate students. The interest rate for undergraduate Direct Loans disbursed on or after July 1, 2025 is 6.39%. The interest rate for graduate Direct Loans disbursed on or after July 1, 2025 is 7.94%.

Direct Loans disbursed on or after October 1, 2020 require a 1.057% origination fee which is paid at the time of disbursement. Thus, 98.943% of the gross loan amount will be disbursed to your student account.

Repayment and consolidation

When you near graduation (or drop below half-time), you will be given information on loan repayment and consolidation. This is referred to as exit counseling (or "the exit interview"). For more information, see our page on loan repayment.

Federal Direct Loan programs carry both annual and cumulative (lifetime) limits. The FAFSA Submission Summary from your FAFSA contains your cumulative borrowing history, and you may also view your entire student loan history online via studentaid.gov.

| Maximum Subsidized + Unsubsidized | Maximum Subsidized | |

| Dependent Freshman | $5,500 | $3,500 |

| Dependent Sophomore | $6,500 | $4,500 |

| Dependent Junior/Senior | $7,500 | $5,500 |

| Independent Freshman | $9,500 | $3,500 |

| Independent Sophomore | $10,500 | $4,500 |

| Independent Junior/Senior | $12,500 | $5,500 |

| Graduate/Professional* | $20,500 | $0 |

| Medical* | $40,500 | $0 |

*The graduate/medical debt limit includes loans received for undergraduate study.

| Maximum Subsidized + Unsubsidized | Maximum Subsidized | |

| Dependent Undergraduate | $31,000 | $23,000 |

| Independent Undergraduate | $57,500 | $23,000 |

| Graduate/Professional* | $138,500 | $0 |

| Medical* | $224,000 | $0 |

*The graduate/medical debt limit includes loans received for undergraduate study.

What happens if I reach a lifetime limit?

If you reach a lifetime loan limit, you will no longer be able to receive any more of that type of loan. If you exceed the limit, aid already disbursed will be billed back. You will have to find alternate ways to finance your education. Therefore it is to your advantage to borrow only what you need for educational expenses, and to keep track of your cumulative debt. Our advisors are happy to work with you to find ways to minimize your borrowing.

Eligibility

First, the student must have a FAFSA on file. Then you may borrow a Parent PLUS loan if:

*The credit approval process does not measure whether a parent can afford to borrow, it only looks to see if there is an adverse credit history. Therefore, a parent with a low income but a clean credit record is likely to be approved.

If you are not the custodial parent, you may still borrow a PLUS on the student's behalf.

How to apply

The Parent PLUS application is a multi-step process. If you do not complete each step, your loan will not be processed.

When to apply

You should begin the application process at least ten days before you need the funds to ensure timely processing. Depending on the time of year, it may take up to 24 hours for the servicer to send notice of your credit approval or rejection.

Applying for maximum

We suggest applying for the maximum amount available to you. You do not have to accept the full amount; you can request a change to your Parent PLUS Loan amount by emailing Spartan One-Stop at onestop@msu.edu. Please note that maximum loan eligibility will change for new borrowers effective July 1, 2026. Please contact Spartan One-Stop or visit studentaid.gov for further information.

Disbursement & Refunds

Counseling

PLUS Counseling is required for borrowers who have an endorser listed on the loan or appeal an original credit decision.

Interest Rate

The interest rate for Parent PLUS Loans disbursed on or after July 1, 2025 is 8.94%. For more information on Parent PLUS Loans, including loan limits, interest rate, fees and more, visit studentaid.gov.

Alternatives if you are not approved

These are some options the family may want to consider:

MSU Short Term Loans

MSU provides low-interest short term loans (7% per year). Loans are usually granted in amounts up to:

Short term loans are available to students who are registered for the current semester and who can demonstrate the ability to repay within 60 days.

Apply for a Short Term Loan at student.msu.edu. Visit your Student Accounts tile and choose "Short-Term Loans" from the "MSU Loans" option in the left-hand menu. Select the Short Term Loan application from the "Loans" menu at the top right. If you meet the criteria, you will be instantly approved and have your funds direct deposited into your bank account.

COGS Loans

The Council of Graduate Students (COGS) offers interest-free 60-day loans up to $500 to MSU graduate students. Please visit the Spartan One-Stop in the Hannah Administration Building, Room 140, to apply for a COGS loan. Loans are administered solely by the Office of Financial Aid and are subject to the availability of funds and the applicant meeting fund qualifications.

ASMSU Loans

Associated Students of Michigan State University (ASMSU) offers interest-free loans up to $300 through the 6th week of each semester (available to both undergraduate and graduate students). For more information, visit the ASMSU website.

Repayment

MSU loans not paid by the due date result in a late fee and a hold on the student's account that prevents a student from enrolling or registering for classes. The student must repay the loan in order to have the hold removed.

Payment options

Students may prepay all or any part of the loan at any time without penalty. There are three payment options available:

Private educational loans are available from a number of lenders for students whose cost of attendance has not been met with other financial aid. The FAFSA (Free Application for Federal Student Aid) is normally not required to apply for a private loan.

Private loan programs differ from federal student loans, and also from Federal Direct Parent PLUS or Grad PLUS loans, in several ways:

Michigan State University has partnered with ELMSelect to offer a tool that will help students and families. ELMSelect has collected all private lenders used by MSU students in the past five years. The tool allows you to select lenders that specialize in your area of study, and to compare rates and conditions in order to select the loan product that best fits your need.

When can I apply for a loan?

You should begin the application process 4 to 6 weeks before you need the funds to ensure timely processing.

When will the loan be disbursed to my MSU Student Account?

Disbursement of funds depends on when the loan is approved. MSU policy is to disburse no earlier than 10 days prior to the student's first day of class in a semester or summer subterm. If that date has passed and the approval process has been completed, MSU will generally disburse the funds within 2 days of receiving the funds from the lender (most lenders release disbursements 10 business days after the loan is approved by the school).

Use the ELMSelect comparison tool to find out when repayment begins on your loan, the interest rate, and any other fees.

Loan proration impacts undergraduate students applying for fall graduation who are receiving federal student loans. When a student will complete their degree in the middle of an academic year, federal student aid regulations require that we prorate the loan based on the student's enrollment level for that final semester.

Max loan amounts by fall credit load

Please note that the actual loan amount may be less if a student has reached their annual or lifetime loan limits prior to fall semester. For prorated loan amounts above 11 credits, visit the full table here.

| Number of Fall Credits | ||||||

| 6 | 7 | 8 | 9 | 10 | 11 | |

| Dependent Student | $1,875 | $2,188 | $2,500 | $2,813 | $3,125 | $3,438 |

| Independent Student | $3,125 | $3,646 | $4,167 | $4,688 | $5,208 | $5,729 |

Before federal loan money can be disbursed, the borrower must sign a Master Promissory Note (MPN). Once signed, the note is good for multiple years (with a few exceptions). If you have any questions, please feel free to contact us.

Federal Direct Loans

The MPNs for the following loans are available at studentaid.gov:

Be sure to correctly specify the type of loan you are signing for, as signing for the wrong loan will delay processing. If you have both subsidized and unsubsidized Direct Loans, you only need to complete one Direct Loan MPN.

Perkins Loan and Health Profession Loans

If you would like to view a previously signed Perkins Loan Promissory Note or Health Profession Loan Promissory Note, please visit controller.msu.edu/receivables/loans-receivables for additional information.

Loan Exit Counseling (The Exit Interview)

When you are prepared to graduate from MSU, we will invite you to participate in Loan Exit Counseling, which you can do in person, by mail, or on the Internet. Loan counseling provides information on what to expect as you begin repaying your loans.

Who to contact after you graduate or leave MSU

Repayment Plans

Options for repayment of federal loans are discussed here.

Loan Forgiveness Programs

Under certain circumstances, the federal government will cancel all or part of an educational loan. This practice is called loan forgiveness or loan cancellation.

Loan Consolidation

A Direct Consolidation Loan allows you to consolidate multiple federal student loans into one loan at no cost to you.” For more information, visit studentaid.gov's loan consolidation page.

Financial Hardship, Deferment, Forbearance, Default

If you are unable to make your student loan payments, there are deferment and forbearance options available. The consequences of defaulting on your student loans are severe, so explore your options BEFORE you default.

More info from the Department of Education on repaying your loans

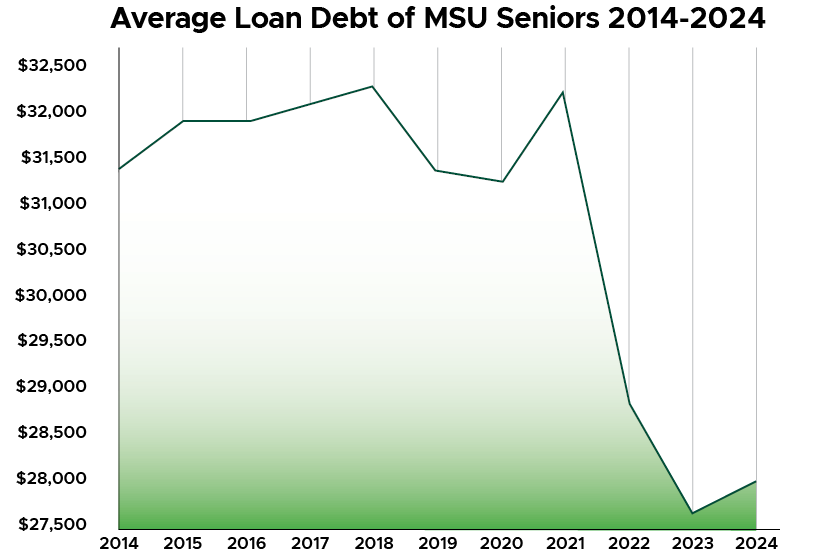

Direct student loans, both subsidized and unsubsidized, are the loans that most students rely on to fund their education if they choose to borrow. A small number of students will borrow private loans in addition to Direct loans. Only Direct Loan amounts for seniors are included in the chart below.

Visit the Graduate Student Loans page for graduate summer aid information.

General information about summer sessions can be found on MSU's Summer Study website.

There is no separate summer application. Students will be processed for summer financial aid based on actual summer enrollment. Students with a FAFSA application for the current aid year will be considered for available financial aid.

Students must be admitted into an aid eligible program to receive summer aid.

If you are planning to study abroad during the summer, contact the Office of Financial Aid about possibly adjusting your budget to account for expenses.

Summer enrollment periods vary throughout the session, since a course may last a few days or the entire summer. Summer aid disbursement cannot occur until 10 days prior to your first day of summer classes.

Students should finalize their schedules before their first day of class. Dropping courses after starting a course may result in a financial aid bill.